Discussions in December between unions and government members failed to reach consensus on the new minimum wage. Photo: ctgcolombia.org

Finance minister Mauricio Cárdenas is facing an angry backlash to the new minimum wage as inflation eats into salaries

The 7% annual rise in the minimum wage announced by the government on January 1 has sparked anger and calls for national strike action from labour unions and social groups who argue that the increase is not enough to counter inflation running at levels not seen in six years.

Workers on the minimum wage will earn COP$689,455 (up from COP$644,350) per month in 2016, which – according to the government – shows that they have strived to protect the poor. The government says it has complied with its constitutional mandate to keep the increase above the annual rate of inflation, which closed at 6.8% in 2015. A sharp devaluation in the Colombian peso has left the central bank powerless to stop inflation from rocketing above the 2-4% target range.

However, those who feel the increase should have been greater claim that 7% is still not enough to compensate the increased cost of living, citing figures like a 10.85% increase in the cost of food last year.

Labour unions have therefore hit back at the decree, calling it “illegal” and saying that in real terms, the increase is below the rate of inflation, meaning that the poorest workers will actually be worse off.

Fabio Arias, secretary general of the Central Workers Union (CUT), told Caracol Radio: “According to our economic advisers, inflation will be 7.16% for the lower estratos who are receiving the minimum wage. In other words we would have an increase that is ultimately below inflation.”

The minimum wage in Colombia is the baseline for many salaries, including governmental ones, as well as various fees, fines and some rents, which are calculated as a multiple of the monthly figure.

There are currently 1,700,000 Colombians earning the minimum wage, and 1,900,000 who earn less than that.

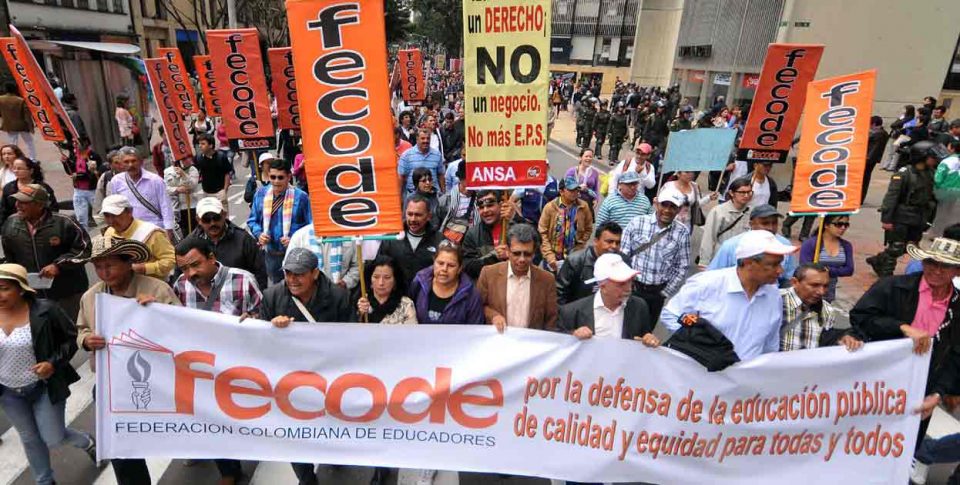

The CUT and the General Labour Confederation (CGT), are demanding change – and planning national strikes, protests and marches.

President Santos assured a conference in Cartagena: “This is the government that has worked the most for the poor. Inflation was much higher than the target of the Banco de la República [the central bank], and that was due to temporary factors such as El Niño and devaluation. I hope that devaluation will slow its pace this year.”

He also said that the policy of ‘intelligent austerity’ was working, pointing to November’s lowest ever unemployment figures and the country’s growth in spite of difficult economic times.

“In economic terms, Latin America is going through one of the worst moments in its recent history and yet the Colombian economy grew 3% or more last year,” said the president.

Tax reform

Colombian workers may soon find their pockets further squeezed if major tax reforms, to be presented to congress this March for potential implementation in 2017, are passed.

With government revenues severely hit by lower oil prices, the government has sought recommendations from a number of groups. One report, by the Commission for Tax Equity and Competitiveness, was leaked prior to being presented – and the various proposed tax increases alarmed many (see box).

While lambasting those who made the report public and highlighting that these were recommendations made by external experts, not the government, President Santos admitted that change was essential.

“We need to simplify our tax system, we need to make our tax system more equitable, because the system we have is not an equitable system,” said Santos. “The poorest are not those who benefit most from the system.”

What’s in the leaked reforms?The 260-page document proposes a number of changes, as well as ways to simplify the system and combat tax evasion. Additional revenues from indirect taxes: • Increased tax on fuel – Charging 5% VAT on goods such as meat, milk, rice, eggs and books Keep the unpopular 4 x 1,000 because it generates about COP$7 billion in tax revenue, which would be difficult to replace. Income tax for more people: • Individuals would start paying income tax on earnings of more than COP$1.5million Changes to corporation tax: • Introduction of a single tax for companies with a flat rate of 30-35% |